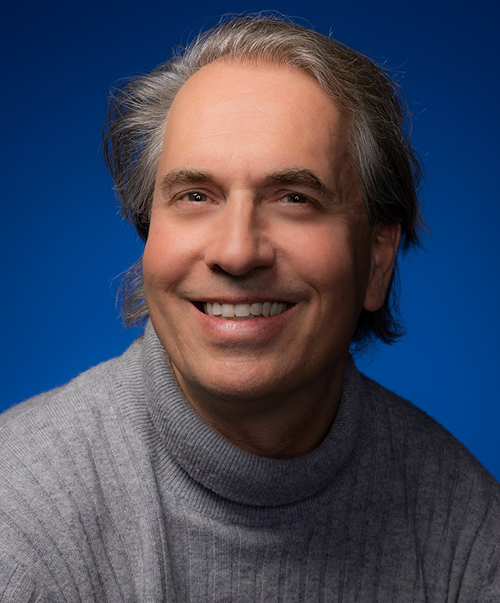

Robert Kraal, Co-founder and CBDO, Silverflow speaks to us about his company, the challenges facing FinTechs today and advice for fellow entrepreneurs.

What initially sparked your interest in the payments and FinTech industry, and what continues to drive your passion today?

My background isn’t in technology or even finance, but in Geophysics – I studied both exploration Geophysicis and Seismology before joining a small startup called Bibit in 1999, which was founded by one of my friends from physics. I started out in software and product development – I had technical skills that could transfer over from geophysics – but because it was a small, rapidly growing company I had to switch roles almost every year, managing product development, acquirers and key accounts. That gave me an appreciation for how varied the industry could be. It wasn’t a case of developing a system and companies coming to you, but a people business where relationships with other parts of the ecosystem matter.

What pivotal moments or decisions in your career have significantly contributed to your professional growth and success?

The experience of Bibit getting sold to RBS and merging with Worldpay in 2004 set me down a career path that led almost 20 years later to Silverflow. I was able to use all the experience I had gained to transition to a management position at RBS Worldpay, then and now one of the world’s biggest and most important payments companies. It was there that my career accelerated and I started to become an expert in payments. It meant that I could speak on the convention circuit and people would listen – we didn’t use the term ‘influencer’ at the time, but that was effectively what I became because I had the Worldpay name behind me. This was important not because I had, or have, all of the answers and the world needs to listen to me, but because being part of the conversation teaches you far more than simply listening.

How do you stay motivated and inspired in an industry that is constantly evolving and facing regulatory changes?

I don’t know how I could not be motivated with the industry as it is! We’re in a strange and often difficult economic situation, the FinTech would recently suffered a major downturn – when a history of 21st century economics is written, this will be the part where things get interesting.

When you are a founder, a big part of the motivation is making sure that the people who took a risk by working at a fairly early-stage company when they could have worked at an established conglomerate are thriving. That doesn’t just mean giving them great pay and benefits (although we absolutely do that), but that we are a family that is moving forward together.

Can you share any upcoming innovations or projects at Silverflow that you believe will significantly impact the industry?

As it is, our technology is years ahead of our competitors, so besides creating new technologies we will be trying to showcase it to the world. We plan to expand geographically, showing that our product offering can solve the payments challenges of any region – look for us in the APAC region first.

We also want to show that we can do more than eCommerce. Our tech is completely applicable to card-present scenarios and we already have several solutions up and running in Europe. The next time you pay, you may be paying with Silverflow technology.

With the rapid advancements in technology, what are the biggest challenges FinTech companies will face in the next five years, and how can they prepare for them?

Billions of digital payments are made each day, and this is only increasing. More people are leaving cash behind and embracing payments using cards, e-wallets or super apps. That’s a great thing, but it’s going to put a lot of strain on the existing payments system. Every time you tap your debit card or pay online you are using systems that in some cases are thirty or forty years old. Clearly, they still work in almost every instance, but at what point are we going to say that they are no longer fit for purpose?

Take data for example: a world run increasingly by machine learning needs a steady supply of high quality data, and legacy payments data weren’t created with this in mind. They were built for a world of expansive storage and RAM memory, slow processing chips and low bandwidth – the 120mbps connections that you can get on your phone were unimaginable at the time. We have the capacity for payments to carry far more data, giving every part of the payments ecosystem much greater insight.

What key pieces of advice would you give to aspiring entrepreneurs looking to enter the FinTech space?

Solve a real problem. That doesn’t necessarily mean stopping climate change, it means knowing enough about a sector, like payments, that you can see the gaps where existing players are saying ‘it’s not great, but we’re just going to have to accept that it will always work that way’. Then, it means working out how you can do better.

We are no longer in a space where investors are thinking purely in terms of growth. Investors are starting to refocus on profit – you may not become an overnight sensation like WeWork, but you will still be a viable business in five years.

Which current technological advancements excite you the most, and how do you envision these technologies transforming the FinTech sector?

I expect that a lot of people will answer ‘AI’ to this question, but honestly the jury is still out on whether the current wave of AI innovation happening in Large Language Models is applicable to finance and payments anywhere but in customer service.

My answer is related though, and it’s the profusion of data we can gather once we have modern payment systems. AI, or rather machine learning, will be a factor once we have that data, since it is able to sift through it and gather relevant insights, but the data has to come first. Currently legacy systems don’t have a source of high-quality information on each and every transaction, but Silverflow does, and once we have it the payments industry can start making strides to address real problems like false declines, fraud and friction.