Airwallex, the Australia-founded leading financial platform for modern businesses, has released The Startup Financial Confidence Report which reveals the opportunities and business challenges facing Australian founders right now.

Further findings from the report include:

Amid a challenging economic backdrop of high inflation, rising interest rates and ongoing economic uncertainty, the report reveals founders are turning to unconventional sources for growth and financial advice. From family to professional networks, founders are looking beyond financial professionals to accelerate their business growth. In addition, 87% of founders have concerns with their bank or financial provider, with 37% saying the flexibility to access funds is a deciding factor when considering a business bank or provider.

- 92% of founders have concerns about their business’ financial operations: The biggest concerns that founders shared involved maintaining compliance, with their top worry being managing local regulations.

- 33% of founders, one in every three, are supported by the Bank of Mum and Dad. Parents aren’t just funding property purchases for the next generation, they’re also bankrolling businesses, as we stand on the precipice of the ‘biggest exchange of gifts and inheritances in human history’ (The Australian, 2024).

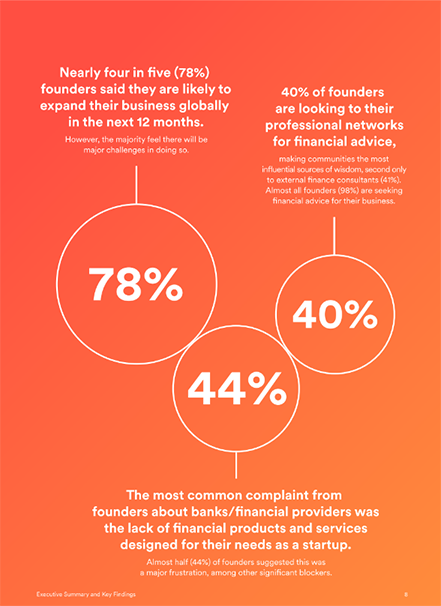

- 40% of founders are looking to their professional networks for financial advice, second only to external finance consultants (41%). Almost all founders (98%) are seeking financial advice for their businesses.

- The most common complaint from founders about banks/financial providers was the lack of financial products and services designed for their needs as a startup. Almost half (44%) of founders suggested this was a major frustration, followed by high fees (37%), poor understanding of needs as a startup (37%) and inadequate flexibility to access funds (35%).

- Nearly four in five (78%) founders said they are likely to expand their business globally in the next 12 months. However, 90% say there are limitations to them doing so.

Taylor Fox-Smith, Head of Community Partnerships at Airwallex, said that, despite the thriving sector, there’s a confidence gap when it comes to steering the finances of a startup.

“This unique research is critical in understanding the needs of this diverse community – and more importantly, identifying what support is needed to help these founders thrive in their startup journeys.

“In today’s volatile economic climate, where funding cycles are tightening and global markets are uncertain, these findings not only illuminate the current challenges but also show the other side of the coin – highlighting opportunities for startups. And there are many – such as the flexibility that comes with using global accounts and mitigating traditional banking restrictions through international payment rails to enable global growth.

“With more than 1,200 Aussie startups now part of the Airwallex for Startups programme, we know there’s a real appetite from founders for support across various areas such as funding and operations. We are confident these insights will empower an ambitious cohort of current and future startups and the next generation of Australian unicorns.”

To download The Australian Startup Financial Confidence Report, visit here.